Tuesday, February 28, 2006

Monday, February 27, 2006

STI - More Up Side?

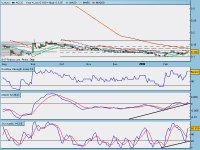

STI Daily

STI DailyLooking at the daily charts, STI is touching the upper band of the Bollinger. RSI, MACD and STO all looks very strong for a push up tomorrow. Likely to test 2500 soon(days to weeks). The possible rise today could be attributed to the Feb SiMSCI futures contract expiring today and traders have to square off their positions. There is also word that those who shorted the SiMSCI will be hard press to cover their shorts today thus the big jump in the SiMSCI today.

I am almost certain that we will see a higher opening tommorow (unless Wall Street has a poor perfomance) It is also good to note that all major global indicies are at their highs. Likelyhood for profit taking before the next run up is remotely possible soon.

I can see from SI forum there are people with contrarian views starting to emerge. There is one commment about selling into strength. I would like to see the STI break new highs weekly however, the contrarian part of me always think otherwise.

STI - Hourly Charts

STI - Hourly ChartsSTI gapped up to 2462.22 this morning, it was strugging to find its direction thru out the morning session and at around 1200hrs, from +3 pts the STI push itself up to +10 pts at the lunch break. If the STI follows the trendline, we are likely to see a higher close today.

SiMSCI (Feb 06 290.8) (Mar 06 291.4) is also at a high, lets see if the spot market will play catch up with the futures. Have a profitable week.

Sunday, February 26, 2006

STI - Weekly

2400 was the key psychological barrier and was tested in early August 2005 but we fail to break it and it retraced to 2200. The STI formed a double top at 2400 in early January 2006 and we tested it again and broke upwards and we are on a uptrend. It is a good run and we are capped at 2450 till last week.

2400 was the key psychological barrier and was tested in early August 2005 but we fail to break it and it retraced to 2200. The STI formed a double top at 2400 in early January 2006 and we tested it again and broke upwards and we are on a uptrend. It is a good run and we are capped at 2450 till last week.The STI was stuck in 2420 to 2450 trading range for a week before we broke the 2450 resistance. However, this break us not “as clean” as desired. Monday's performance will set the tone for the rest of the trading week. If we are able to hold the STI above the 2450, then we are on our way to test 2500.

STI's all time high of 2582.94 was in March 1st 2000 at the height of the Dot.Com boom. Can we see that? There is an Investment bank that say that the STI could achieve 2700 in 2006. We shall see!

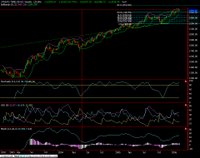

Wall Street - Weekly

Wall Street's key indices's uptrend are still intact and they fought off a bear last friday when oil surge.

DJIA

It is sitting on the 11000 support, on friday it almost tested the support but bounced off 11010. From the high of 11084.92 to the low 11010.86, it was a 75 pts trading range as the Bull and Bears have a fight. The Bear with a oil advantage eventually backed of and the DJIA close only 7 pts down. Lets see what Monday brings us.

S&P500

The S&P parted ways with the DJIA as it remained positive almost through out the entire trading session. The mix picture of the indices's could be due to the different weight age of stocks in the S&P and DJIA. Techs and Oil were the leaders in the S&P and it was clearly seen why the Tech Heavy Nasdaq was up as well.

Saturday, February 25, 2006

Commentary - Wall Street and Oil

Wall Street's performance on Friday is impressive considering that oil almost by US$2.37 to US$62.91 per/barrel. Wall Street shows resilient to high oil price (at least up to US$70 per/barrel)

I think the world markets is fed up to be held ransom by high oil. Disruption of supply, terrorist attack on oil installation, kid-nap by leftist rebels, the list goes on.

It is gratifying to see the world markets take in stride such negativity and focus on the the fundamentals. America had a good 2005 and looking forward to a good 2006. They are expected to revised their GDP numbers and it will certainly give a leg up to Wall Street.

Wall Street Closing Numbers

Dow Jones

Close: 11,061.85 Change: -7.37 -0.07%

Open: 11,065

High: 11,085

Low: 11,010

S&P500

Close: 1,289.43 Change: +1.64 +0.13%

Open: 1,288

High: 1,290

Low: 1,286

Nasdaq

Close: 2,287.04 Change: +7.72 +0.34%

Open: 2,278

High: 2,288

Low: 2,273

I think the world markets is fed up to be held ransom by high oil. Disruption of supply, terrorist attack on oil installation, kid-nap by leftist rebels, the list goes on.

It is gratifying to see the world markets take in stride such negativity and focus on the the fundamentals. America had a good 2005 and looking forward to a good 2006. They are expected to revised their GDP numbers and it will certainly give a leg up to Wall Street.

Wall Street Closing Numbers

Dow Jones

Close: 11,061.85 Change: -7.37 -0.07%

Open: 11,065

High: 11,085

Low: 11,010

S&P500

Close: 1,289.43 Change: +1.64 +0.13%

Open: 1,288

High: 1,290

Low: 1,286

Nasdaq

Close: 2,287.04 Change: +7.72 +0.34%

Open: 2,278

High: 2,288

Low: 2,273

Friday, February 24, 2006

Lu Zhou IPO - 5 Mins

Following up with day 1 trading. Volume is at a respectful 98,630 lots done with a high of 43 cents

Updated Luzhou's charts, only one thing to say.....Amazing.

Congrats who tikum and kena this IPO, CONGRATS!!! more than 50% profit. Unable to get any heads or tails from the indictors. So just have volume as a refernce.

Congrats who tikum and kena this IPO, CONGRATS!!! more than 50% profit. Unable to get any heads or tails from the indictors. So just have volume as a refernce.I bidded for this IPO but never kena...no chicken lice or coffee money.....

Thursday, February 23, 2006

StarHub - Hourly

Looks like StarHub is back on track, a solid rebound from $1.91 The chart looks like it is in a typical "in anticipation of good results" rise/formation. If the results announced later today is better than expected and dividend payment higher, likely to see StarHub propel higher tomorrow to test is previous high of $2.21

Looks like StarHub is back on track, a solid rebound from $1.91 The chart looks like it is in a typical "in anticipation of good results" rise/formation. If the results announced later today is better than expected and dividend payment higher, likely to see StarHub propel higher tomorrow to test is previous high of $2.21Vested.

Singtel Daily - 4th Wave?

A quick scan of the charts shows the indicators achieving lower highs after SingTel recent high of $2.70. It is likely to into retracement to gather strength for its next leg, If my analysis of Elliot Wave is correct, this should the 4th wave (corrective phase) before the 5th wave. (i apprecate any correction of my analysis as i am a newbie to Elliot Wave) You can see the MA all coverging at the 200MA area, likely to be a key support.

Wall Street - Mid Night Madness

Just got back from work, Wall Street is having a small rally, when penning this article.

Dow Jones + 75.24

S&P 500 + 7.73

NASDAQ + 13.13

Looks goods, if this continues and Wall Street close high, we can see STI opening gapping up.

Good Nite

SM

Dow Jones + 75.24

S&P 500 + 7.73

NASDAQ + 13.13

Looks goods, if this continues and Wall Street close high, we can see STI opening gapping up.

Good Nite

SM

Wednesday, February 22, 2006

STI - More Down Side?

Hummm.....a series of lower highs for the indicators. Today was a medium volume (1.18 Billion Shares Traded) slide. STI was down 15.57 pts (-0.64%) to close at 2427.89. A/D line is 195/345.

Hummm.....a series of lower highs for the indicators. Today was a medium volume (1.18 Billion Shares Traded) slide. STI was down 15.57 pts (-0.64%) to close at 2427.89. A/D line is 195/345.STI is sitting on the 20MA, looks like there is more downside than up (barring unforseen news) All the key asian regional indices are also down. Europe is down when i am writing this post. Wall Street Futures are unchanged pending some economic data today. Looks like the bear is going to show it prowlness as the bull goes into hiding.

Good Nite

SM

Not So Brilliant - Daily

I am going to use my fav word when I see a performance (the lack of) like that, DISMAL!!!

I am going to use my fav word when I see a performance (the lack of) like that, DISMAL!!!Yesterday's effort and mini-cheong was all flush down the bowl. Low volume nudge down.

Tomorrow's perfomance is important, if the slide continues, we could see a possible test of the 30 cents support (wah lau eh) I am keeping my fingers cross. Vested.

Venture - Daily

Good set of results. However, the anal-list have 2 camps now. Some shouting buy (cos they have and want to sell) some shouting sell (cos they dun have and want to buy) We got a famous local one which is shouting "SELL"

Good set of results. However, the anal-list have 2 camps now. Some shouting buy (cos they have and want to sell) some shouting sell (cos they dun have and want to buy) We got a famous local one which is shouting "SELL"Anyway, back to the charts. It is a good close ( closed 10 cents higher at $13.40) Point to note is volume was half of yesterday, there are a little more buyers than sellers today which point to more possible upside if we look at the daily charts. It is now sitting between the 50% and 61.8% retracement. MACD, STO and RSI all look healthy and we could see Venture testing $13.50 tomorrow (61.8% retracement from $14.50 and yesterday's resistance)

Good luck to those vested. VENTURE CHEONG AH!!!

My Key Support

A mids the hussle and bussle of me trading, staring into charts and looking at figures. I would like to thank my girlfriend for understanding what I do and supporting me in every trade I take.

Thank you Baby

Thank you Baby

Tuesday, February 21, 2006

Brilliant - Daily

This fellow was quietly sitting at 31 cents this morning and BAMB! after lunch at 1506hrs, it got hit and hit and hit all the way up to 33.5 cents and held at 33.0 cents till closing, volume is 6.3 time more than the previous day. Hourly charts show reversal and if price holds for tomorrow, likely to see reversal in day charts. Resistance likely at 35 cents.

This fellow was quietly sitting at 31 cents this morning and BAMB! after lunch at 1506hrs, it got hit and hit and hit all the way up to 33.5 cents and held at 33.0 cents till closing, volume is 6.3 time more than the previous day. Hourly charts show reversal and if price holds for tomorrow, likely to see reversal in day charts. Resistance likely at 35 cents.Vested.

Monday, February 20, 2006

SPH - Anal-Lyst cover, so i also cover

Over the last week, the "buy" calls for SPH reach a feverish amount, ML $4.90 CSFB $5.10, BT calls it a laggard play (recent high of 4.96 - 11 Oct 2005 - just before FY05 results)

FA + TA = $$$

SPH now is being recognise as a laggard play in the index and "everybody" is hoping it plays catch up. So with what i call "Self-fulfilling prophecy" it will just move up.

The charts show the price sitting on the 20 and 50 MA, so that will act as a soild support for SPH and plus the indicators are screaming a cheong up! $4.40 is a key resistance, once broken, we could see the target being hit. Now no time to do detail charts, will update once at home.

Vested